Everyone has to start somewhere, and the same holds true for building credit.

Technically speaking, your 18th birthday is the starting point for many things as an "official," legal adult. Among your newly minted rights is the eligibility to apply for credit.

A good credit score is crucial to opening so many financial doors in your life, including buying or leasing a car, getting a credit card with a low rate and a higher limit, and even getting insurance premiums at affordable rates. And while not everyone is ready to start building credit the second they turn 18, as life starts happening, the value of building a solid credit history and score becomes clear.

The Catch-22 of Credit, however, is that it usually takes having credit to get credit. Most people from age 18 into their 20s and sometimes beyond don't have any baseline to start from, so it can be tricky to get started.

Don't give up before you get started building credit. Just keep reading because we have easy, actionable advice for you on how to start a credit score.

Before you have a credit score...

According to Experian, a starting credit score isn't zero, but actually no score at all. You get an initial number for your credit score once you have one or more accounts open for at least six months AND the lender or creditor has reporter this to at least one credit bureau.

Until this happens, you won't have a record with the credit bureaus, and if a potential lender searches for you, they'll get a report that says, "Too new to rate." Once six months has passed, your credit history, though young, will be ready for scoring.

What's your starting credit score?

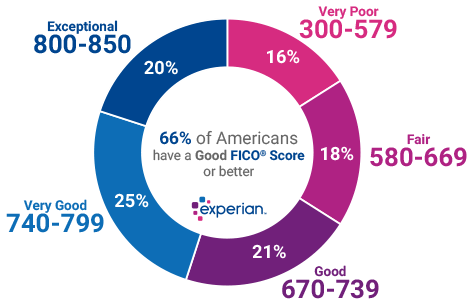

Generally speaking, your score will be somewhere between the lowest possible score (300) and the highest (850). For most people who have just one or two accounts open but consistently make payments on time, that first score will likely be somewhere in the middle range of 580-669 (fair). There's just not enough of a history yet for credit bureaus to access your creditworthiness.

Wondering how to build credit at 18? Or even later in life? Don't worry, because there's plenty you can do to get your credit history - and score - moving in the right direction.

How to start building credit

The following list includes 18 ways to get your credit building journey off to a strong start. It includes not only smart steps to take, but also critical habits to develop so your credit scores improve over time - opening as many financial doors as possible for you.

1. Open a student credit card.

While you do need a credit score to qualify for most credit cards (and be over the age of 21), there are a number of student credit cards for which you can qualify with no credit history. Make sure you do the legwork to be sure you're getting a credit card that has a low APR, has great pluses like points, and boasts higher approval odds.

2. Get credit for paying rent.

If you're living in an apartment or even renting a room in a house, one of the best ways to start building credit without taking on debt is to get your rent payments for reported to the three main credit bureaus (Experian, TransUnion and Equifax). Even if your parents are helping out with the rent, as long as you're the one with the RentTrack account, you'll be building your credit history.

3. Get a cosigner so you can rent a place or open a credit card account.

Those first two ways to build credit will likely require you to have a cosigner, which is a responsible party who applies with you for a loan, credit card or lease and agrees to pay off your debt if you default. Be sure the person who's cosigning for you is responsible and has a solid credit track record, too.

4. Become an authorized user on someone else's account (i.e.. your parents).

As long as they have good credit and consistent payments, you'll benefit from being authorized on an established account. And it's a win-win - your good behavior of on-time, consistent payments can also help boost their credit score, too.

5. Be smart in managing your student loans.

Student loans are among the few loans that don't necessarily require a credit history; federal student loans are need-based and don't ask for a credit score. But your student loans will be an important factor on the credit history you're building, so be sure to make on-time payments and take other positive, proactive steps over time as you manage it. Blowing off loan payments when they start coming due is a sure way to drag down your future credit score.

6. Take out a credit-building loan

This is from a credit union or community bank, where the loan sits in a savings account, that you then you access once the loan term is up. This helps you both save money and build credit.

7. Make payments on time, all the time.

This is credit score 101: your payment history makes up the biggest chunk of your credit score - 35 percent. Getting into the habit of always paying your bills on time is one of the best ways to keep that number moving into the "good" or "excellent" zone.

8. Open a secured credit card.

This kind of credit card requires a deposit, which becomes your line of credit. Just be sure the credit card company reports this information to credit bureaus so you can benefit.

9. Get in the habit of regularly looking at your credit history.

Once you have a history, it's on you to safeguard it. You can get a copy of your credit report from all three bureaus for free once a year, and you should check it carefully to be sure you didn't accidentally miss a payment or have any negative or fraudulent information reported.

10. Open one card at a time - and limit new accounts.

It might seem counterintuitive to not open a ton of accounts to build credit quickly, but the truth is this will only backfire. Lenders and creditors look at this as evidence that you're getting in over your head with too many new accounts - so this actually lowers your credit score.

11. Minimize your debt load.

Always be aware of your "debt load," which is the ratio of your income to the debt you carry. So while it may be tempting to use the maximum amount of credit on your new cards, this is the kind of irresponsible financial behavior that both drags down your credit score and also is a big red flag to lenders and creditors.

12. Keep your credit card balances low.

An excellent habit to get into from your first credit card until, well, forever, is to pay off your monthly balance when you can, or at the very least, keep your balance to no more than 30% of your card's credit limit.

13. Plan to leave credit card accounts open.

Once you open a credit card account, it's a good practice to leave it open, even if you don't use it. Another important credit score factor is credit utilization, which measures how much credit you have against how much you use, so having a card you use infrequently or never can actually lower your credit utilization ratio. This is a good way to boost your overall credit limit without increasing your debt. The longer you have the card, the better, too.

14. Fight any erroneous charges you see on your credit report.

One of the best ways to spot identity theft and fraud is on your credit history. If you even have a credit history before you turn 18, there's a good chance you've been scammed because technically you have to be over 18 to get credit. And statistically speaking,younger people are more likely to fall prey to scammers than older folks - so stay vigilant and immediately report to credit bureaus any information you know to be false.

15. Take care of large or late debts as soon as possible.

So far we've been discussing ways to stay proactive and keep your credit scores steadily increasing. And all debt isn't bad - in fact, if your account is current, it actually helps build your credit score. But what happens if you fall behind on making payments? While those late/missed payments and excessive debt will have a negative impact on your credit scores for as long as seven years, if you do your best to fix problems ASAP, their impact will decrease over time.

16. Make sure "alternative data" is reported to all three credit bureaus.

The credit bureaus are now using "alternative data"- information that speaks to your creditworthiness beyond the traditional sources to give a more holistic picture - to calculate your scores. On-time rent payments are just one example of alternative data, with other payments like utilities factor in, too.

17. Familiarize yourself what credit bureaus do - and why you should care.

While there are actually numerous credit bureaus, the top three - Experian, TransUnion and Equifax - are the ones creditors and lenders turn to when deciding whether or not to extend credit to you. They are similar, yet each uses slightly different scoring models, which means your score will vary a bit by bureau. Because you never know which one a potential creditor/lender will pull your history and score from, you should be sure that you're reviewing your data from all three on a regular (at least annual) basis.

18. Relax, it's not about where you start - your credit score is a journey.

Credit scores are always a snapshot of a moment in time, and over your lifetime, your score will fluctuate depending on a number of variables. By getting into good behaviors at the outset, you'll be well positioned to ultimately do things that many of us aspire to: buy a house, a car, start a business with a loan or at least a credit card with a significant limit, and so on.

So take our advice, and give yourself some credit: just by reading this blog, you're already ahead of the game.

Interested in learning more? Take a look at the following resources that can also help you get off to a strong start in your journey to build credit:

Want an A+ in Life? Start Building Credit While You're in College

The Responsible Person's Guide to Getting a Cosigner

Credit Scores 101: What They Are, How They're Calculated & Why You Need Them

5 Ways to Rent Your First Apartment Without Credit

Give Your Credit Score Some Love With These 5 Simple Steps

Here's What the Three Credit Bureaus Actually Do (And Why You Should Care