If you're one of the 60 million adults in the U.S. who are "credit invisible," meaning you don't have enough data on your credit file to generate a credit score, you know how hard it is to improve your financial life. With no score, or a "thin file," you aren't able to qualify for loans, open credit cards or other accounts (i.e. mobile phone), and in some cases, get a job or a rental apartment. This frustrating issue disproportionately affects people with lower incomes, certain ethnic groups, and young people just starting out.

The government and top three credit bureaus (Experian, TransUnion and Equifax) realize that this issue is not only unfair to consumers, but it also significantly limits potential new business for many lenders. The Catch-22 of Credit, which says you need credit to generate a credit score, but you can't get credit without a credit score, is an unfair cycle that must be broken.

Enter, "alternative data."

Alternative data, which gives a more holistic picture of a person through his or her digital footprint, is a totally new and different way of assessing creditworthiness. This growing trend among lenders in the U.S and worldwide involves using different data sources, particularly those that speak to an individual's behavior, to make better – and in many cases, more inclusive – decisions about extending credit and granting loans.

What are the sources of "alternative data"?

FICO uses the data on your credit report (including some alternative data) to calculate your credit score — which helps lenders predict how risky it would be to lend to you. A higher score shows lenders that you are more likely to fully pay back your debt on time.

So what is alternative data, and how can it help lenders decide whether or not to lend to you?

According to FICO, "It generally refers to any data that is not directly related to a consumer's credit behavior. Traditional data usually means data from a credit bureau, a credit application or a lender's own files on an existing customer. Alternative data is everything else."

The "anything else," according to FICO, includes things like:

Bill Payment Data: Consistent monthly payments are a strong indicator of positive financial behavior. While both rental and utility payments should be included on your credit history, the practice of reporting those payments to credit bureaus is still relatively new and therefore considered "alternative." FICO includes this data in its FICO® Score XD in the United States.

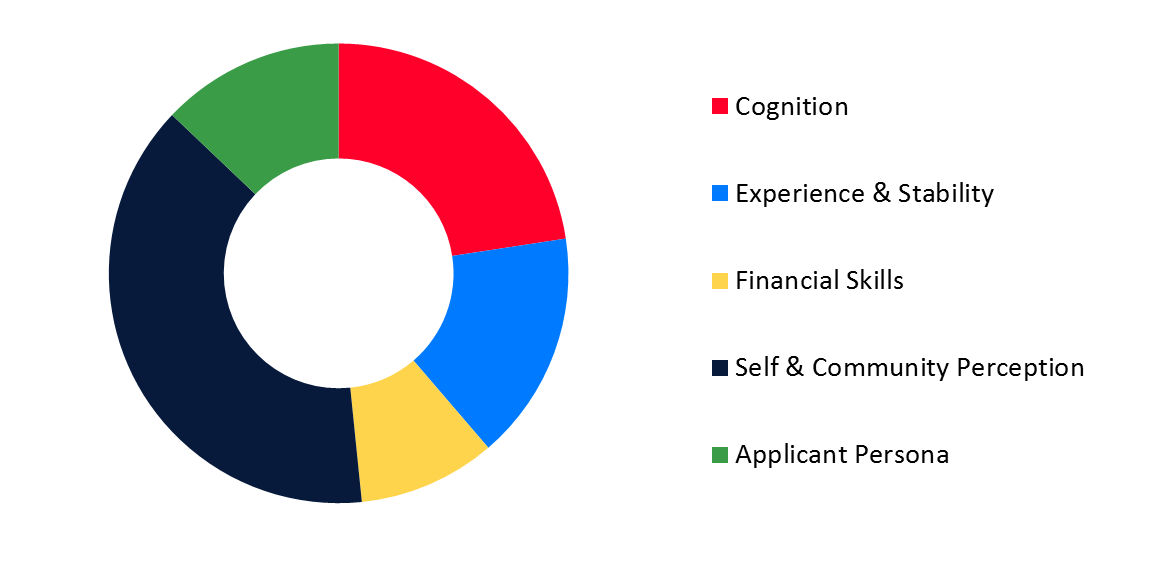

Survey / Questionnaire Data : Using psychological information ("psychometrics") to evaluate someone with no or little credit is an innovative way that FICO is considering using to score otherwise "credit invisible" individuals. Conducted using a fun, interactive survey, the psychometric assessment asks questions designed to reveal character traits that have a proven relationship to credit risk.

Source: FICO

Other Non-Financial Data: Public online behavior, such as how people behave and with whom they interact with on social media platforms, can support the idea that an individual exhibits responsible behavior. Because of privacy concerns, however, most companies are treading very lightly when it comes to using this kind of information. Still, mining this kind alternative data can be promising if proper safeguards to protect privacy are in place.

Credit bureaus on alternative data and a more "holistic" picture

The big idea behind using alternative data is to go beyond traditional scoring models and use more expansive criteria to help give "credit invisible" consumers greater opportunities to qualify for loans and credits.

As Experian says, "By pulling in new data sources that include alternative financing, account aggregation, as well as on-time utility and rental payments, we can provide a more holistic view of all consumers. These insights can help lenders identify and prevent fraud, determine an applicant's ability to pay, and verify an identity."

For the data to provide credible insight, Experian goes on to note that it must have aspects to it that easily show a pattern of behavior that points to "a consumer's ability, stability and willingness to pay."

TransUnion also has its own alternative data product, which includes "trended credit," and points out that risk strategies are evolving. This benefits not only the consumer, but also companies who will serve their bottom lines by open doors to those otherwise considered "unscorable." And Equifax's alternative data solution similarly supports the idea of adding financial context with how people pay everyday bills, for example, to help companies serve higher-risk customers and initiate "more inclusive account opening strategies."

Thanks to today's data explosion, alternative data has become a more viable option for lenders and other creditors to assess creditworthiness. With the inclusion of rent reporting alone, Experian saw an average VantageScore increase of 29+ points. As the alternative becomes more mainstream, opportunities to obtain credit becomes more common, too.